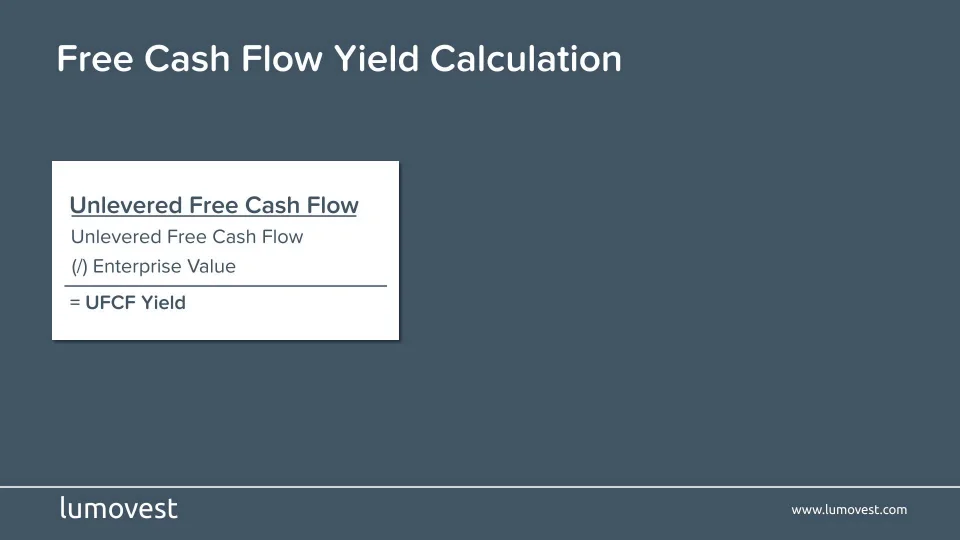

unlevered free cash flow enterprise value

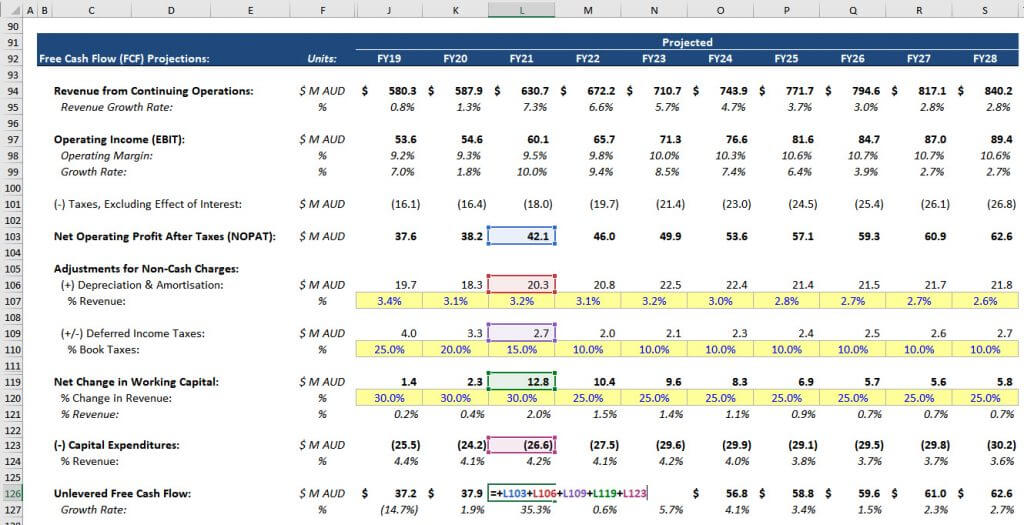

Unlevered free cash flow can be reported in a companys. UFCF EBITDA - Capital expenditures CAPEX.

A business or asset that generates more cash than it invests.

. Five years later at exit the firm generates cumulative free cash flow of 500 million and uses all the FCF to pay down its. View Victorias Milling Company Incs Unlevered Free Cash Flow Yield trends charts and more. Unlevered free cash flow UFCF is the cash generated by a company before accounting for financing costs.

If youre using Levered FCF Free Cash Flow to Equity instead you use Cost of Equity as the Discount Rate instead because you only care about Equity. Unlevered free cash flow UFCF is a companys cash flow before taking interest payments into account. Unlevered free cash flow UFCF is a companys cash flow before interest payments are taken into account.

Victorias Millings latest twelve months unlevered free cash flow yield is 73. It is the amount of cash a company generates after. It is the inverse of the Free Cash Flow Yield.

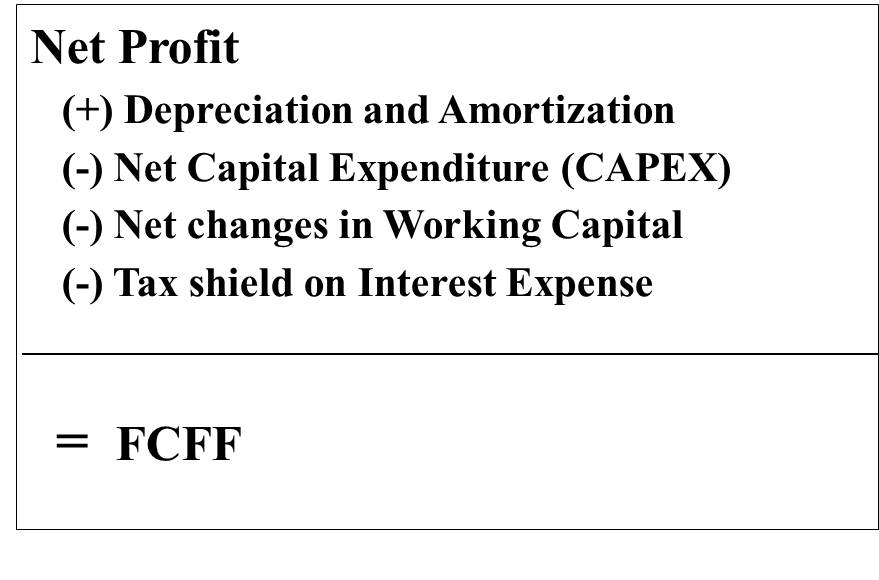

Unlevered free cash flow formula. Unlevered Free Cash Flow Formula. When calculating UFCF you consider EBITDA.

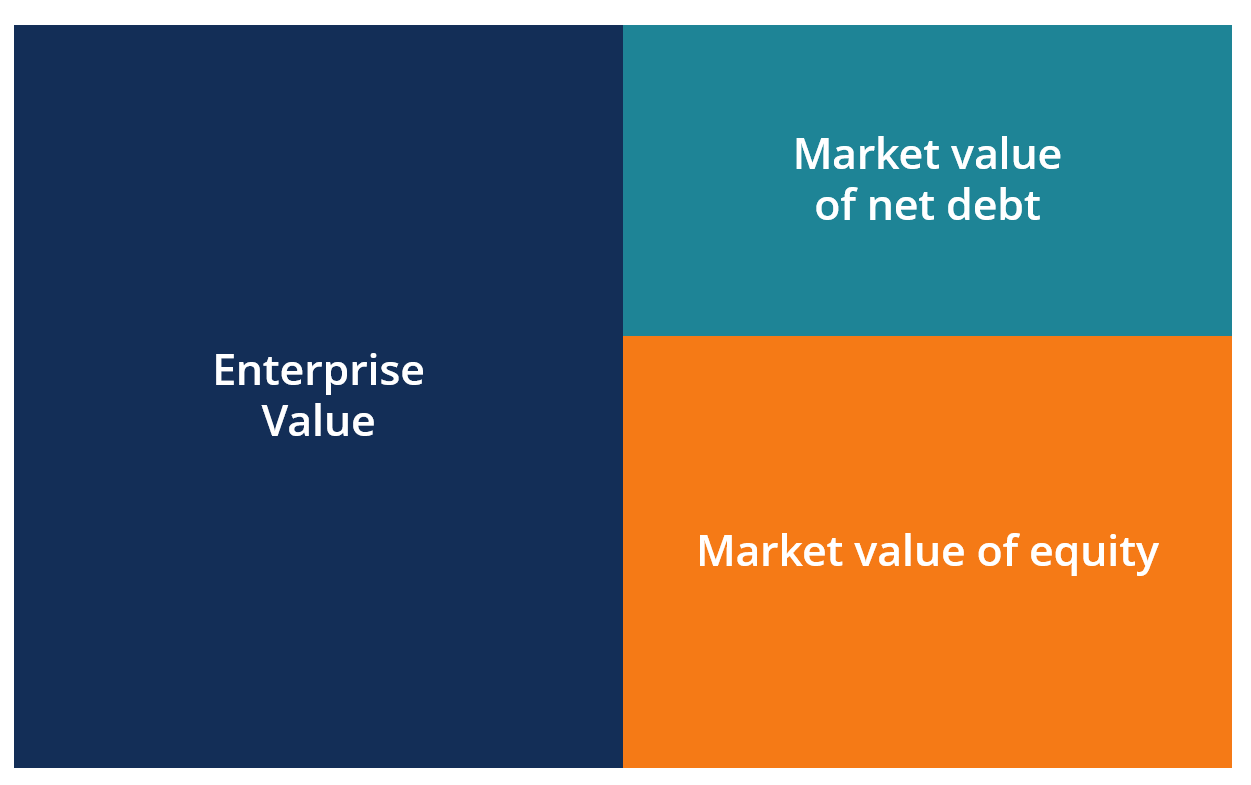

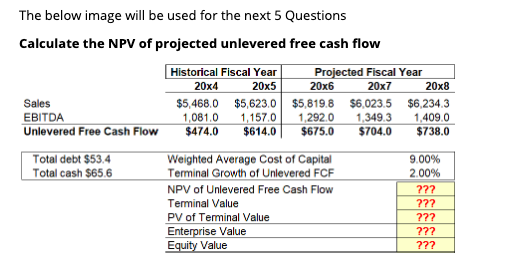

This metric is most useful when used as part of the discounted cash flow. Therefore Enterprise value is 1000 million at Year 0. Unlevered free cash flow UFCF is used at a high level to determine the enterprise value of a business.

How to calculate unlevered free cash flow. The lower the ratio of enterprise value to Free Cash Flow the faster a company can pay back the cost of its acquisition or generate cash to. Unlevered free cash flow UFCF is the cash flow available to all providers of capital including debt equity and hybrid capital.

The average consumer may not ever see or need to know. The formula of free cash flow of a firm is given below. Free cash flow of a firm Earning for shareholders Redemption of capital - Issue of fresh capital Increase in.

Unlevered free cash flow is used in both DCF valuations and debt capacity analysis and represents the total cash generated for both debt and equity holders. UFCF can be reported in a companys financial statements. Get the tools used by smart 2.

Levered cash flow is the. Unlevered free cash flow is a term used in corporate finance and investment analysis to discern a companys value. Unlevered Free Cash Flow NOPAT Depreciation Amortization Increase in Net Working Capital NWC Capital Expenditures.

RFMs latest twelve months unlevered free cash flow yield is 02. View RFM Corporations Unlevered Free Cash Flow Yield trends charts and more.

Ib Technical Interviews Walk Me Through A Dcf Part 2 Youtube

Building A Dcf Using The Unlevered Free Cash Flow Formula Fcff

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Free Cash Flows Fcf Unlevered Vs Levered Financial Edge

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Free Cash Flow Fcf Most Important Metric In Finance Valuation

Terminal Value In Dcf How To Calculate Terminal Value

Cash Flow Valuation Part 4 Of How To Value A Small Business Genesis Law Firm

Free Cash Flow Yield Formula And Calculator

Enterprise Value Ev Formula Definition And Examples Of Ev

Levered Free Cash Flow Tutorial Excel Examples And Video

How To Calculate Unlevered Free Cash Flow In A Dcf

Solved Calculate Terminal Value Calculate The Pv Of The Chegg Com

Unlevered Free Cash Flow For Dcf Modeling Keyskillset

Business Valuation Models Two Methods 1 Discounted Cash Flow 2 Relative Values Ppt Download

Free Cash Flows Fcf Unlevered Vs Levered Financial Edge

Levered Vs Unlevered Free Cash Flow Top 7 Differences

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial